10 Nov 45L Tax Credit for Multifamily

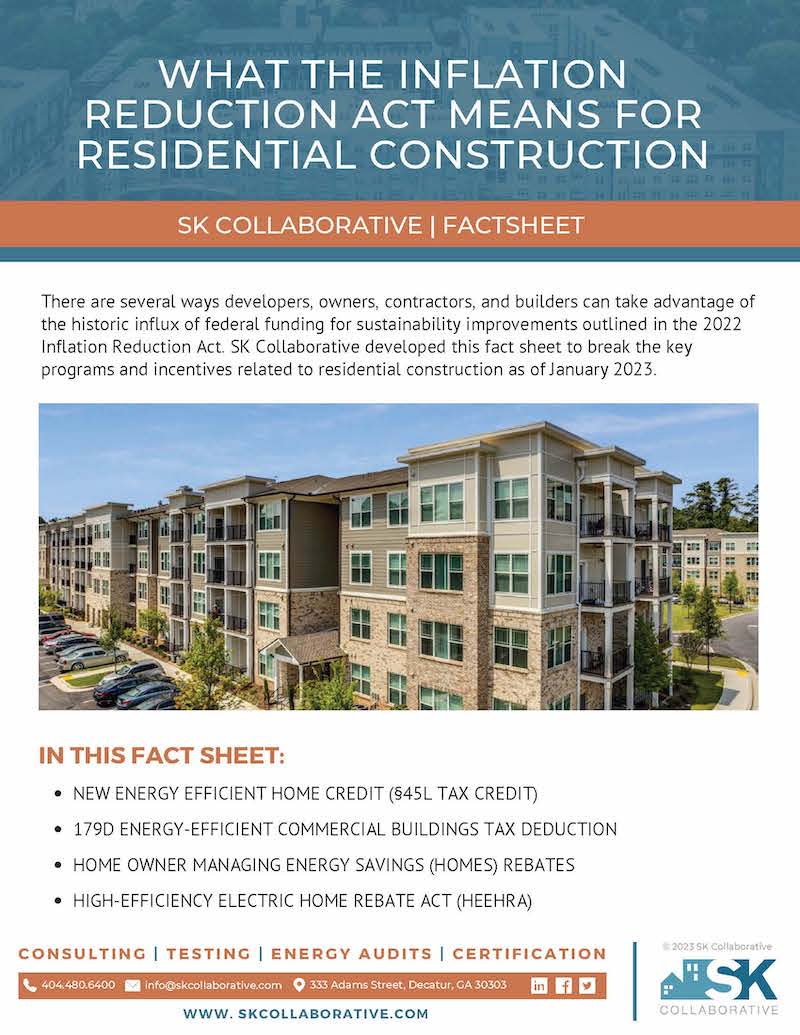

The IRA updated the New Energy Efficient Home Credit (§45L Tax Credit) and extended it through 2032. Affordable housing with LIHTCs can use the §45L tax credit without a basis judgment. Multifamily developers and contractors of new construction and substantial renovation projects are eligible to apply for the newly increased credit amounts:

$500/unit for ENERGY STAR certification

$2,500/unit for using prevailing wages

$1,000/unit for DOE Zero Energy Ready Home (ZERH) certification

$5,000/unit for using prevailing wages

This fact sheet provides an overview of the New Energy Efficient Home Credit (§45L Tax Credit) applied to multifamily developments and SK Collaborative’s insights on meeting the ENERGY STAR and ZERH requirements.

Fill out the form below to download your free copy of the 45L Tax Credit for Multifamily Developments.

"*" indicates required fields

Sorry, the comment form is closed at this time.